Other publications

Raids, Seizures & the “Russian Trace”: Protecting Business in Ukraine – LBA

Raids, Seizures & the “Russian Trace”: Protecting Business in Ukraine – LBA

Table of Contents:

The illusion of safety is over. If you thought the war had paused the “shaking down” of business by law enforcement — I have bad news for you. At LBA, we are recording a return to the worst practices of the “pre-February 24” era, but with a cynical upgrade.

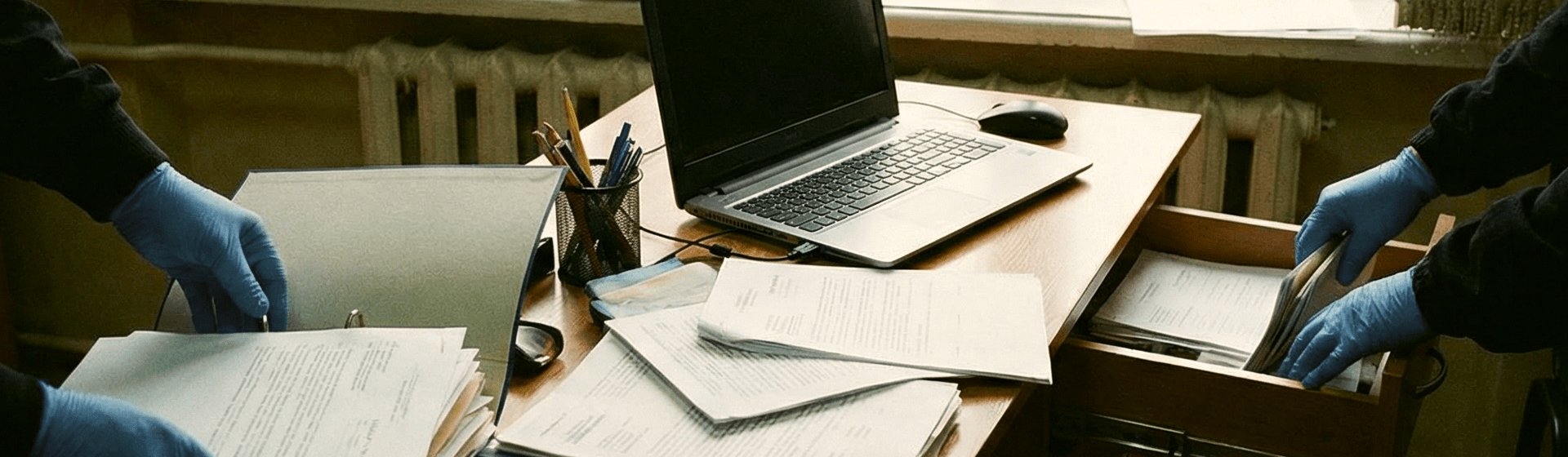

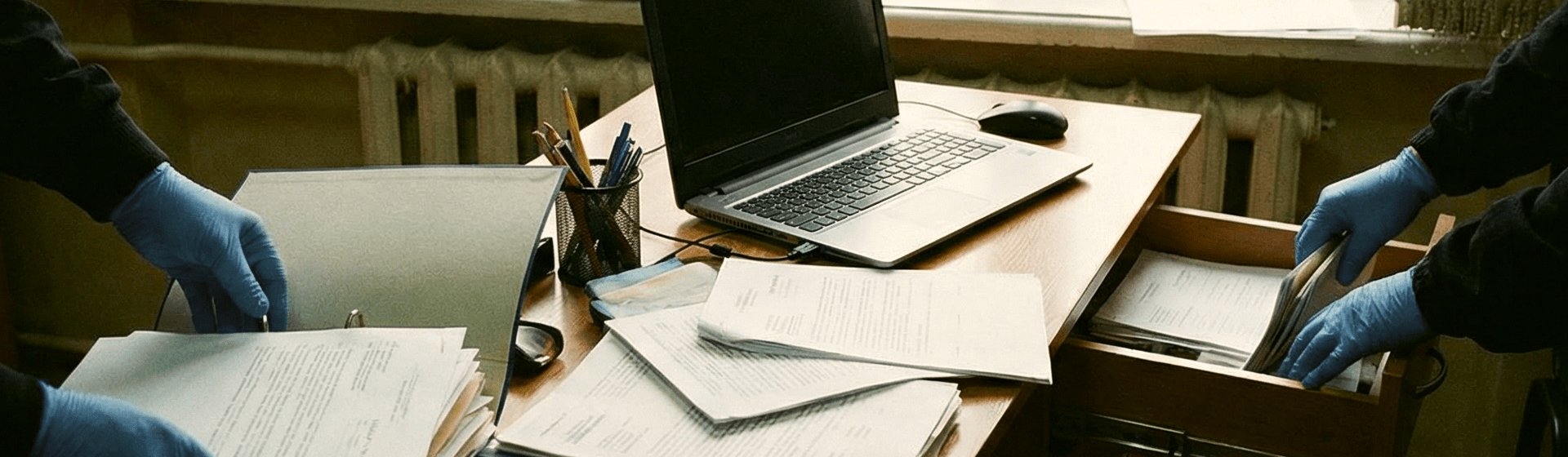

Currently, any business conflict or tax optimization is reclassified by investigators as “financing terrorism” or “working for the aggressor.” This is convenient for the system.

Such qualification allows them to kick the door down without hesitation, ignore investigating judges’ rulings, and block company operations for months. Inspectors and investigators have returned from “hibernation.”

Law No. 3219-IX has reinstated tax audits, and the ESBU (Economic Security Bureau of Ukraine), which was intended to be an analytical body, has in practice adopted the forceful habits of the disbanded tax militia.

You need to understand how an ESBU, SBI (State Bureau of Investigation), or SBU investigator thinks when signing a search warrant motion. Their goal is not to find the truth. Their goal is business paralysis.

The pressure algorithm looks like this:

They know perfectly well that the judicial process for returning property can take months due to court overload and constant prosecutor “no-shows.” That is why we at LBA act exclusively proactively.

In practice, we often see the same mistake: the director tries to explain “humanly” to investigators that a mistake has occurred. Forget about it. Your defense strategy must be tough and legally verified.

The investigator will demand passwords for phones and laptops. The Criminal Procedure Code does not oblige you to provide passwords. This is your constitutional right to defense.

Risk: If you give the password, they will “download” not only work documents but also personal correspondence to find levers for additional pressure.

LBA Solution: The equipment will be seized anyway. But it is better for it to lie locked in the evidence storage room than for the investigation to get full access to your client-bank right now.

Remote support does not work here. The investigation team often “forgets” to enter seized items into the protocol or lists them in general phrases (e.g., “blue folder with documents”). This is a procedural trap.

Our strategy is that lawyers force them to rewrite every single sheet. This drags out the search for 10–15 hours. Investigators get tired and make mistakes, which then become solid grounds for canceling the asset seizure in court.

Keeping servers physically in the office is suicide for a business. Rent capacity abroad (Germany, Netherlands).

When operatives enter the server room and see empty racks, their enthusiasm vanishes instantly. It is physically impossible to seize the “cloud.”

Read also from our practice: How to prepare the office for an ESBU visit: security checklist

The most popular trend recently is accusations of ties to the aggressor state. Even if you last sold goods to Belarus 5 years ago, this can become formal grounds for freezing assets.

Real case from LBA practice:

Our client (a logistics company) had their accounts blocked because one of the counterparties had a beneficiary with dual citizenship, which our client did not even suspect.

What we did:

Result: Accounts were unblocked in 2 weeks, and the business is operating normally. Although law enforcement counted on months of company downtime.

1. Can a search be conducted at night during martial law?

Yes, Article 233 of the CPC of Ukraine allows entry into a person’s home or possession without a court order in “urgent cases.” Law enforcement often abuses this, citing the threat of destruction of evidence. Your task is to record every action they take in the protocol remarks.

2. ESBU blocked tax invoices. What to do?

This is a classic pressure scheme. You need to submit a taxpayer data table with a detailed explanation of the business specifics and copies of all documents. If administrative appeal does not work, we go to court. Court practice is increasingly siding with taxpayers.

3. Is it worth negotiating “unofficially”?

Categorically no. Today, “fixers” are often part of a bribery provocation. You risk getting Art. 369 of the Criminal Code (offer of improper benefit) as well. Work only within the legal field.

The state declares support for business, but “on the ground,” investigators work according to old manuals. Your defense is not hope for justice, but a correctly built legal fortress.

Do not wait until they knock on the door. If you see suspicious activity from the tax office or requests from law enforcement, this is a signal. Contact LBA. We don’t just know the laws; we know how to break the system’s predatory logic and protect your financial result.

Denis Fedorkin

Managing Partner of Law Business Association (LBA)

Over 17 years of experience in business protection, tax law, and countering corporate raiding. Expert in building corporate security systems and interacting with law enforcement agencies.

Other publications